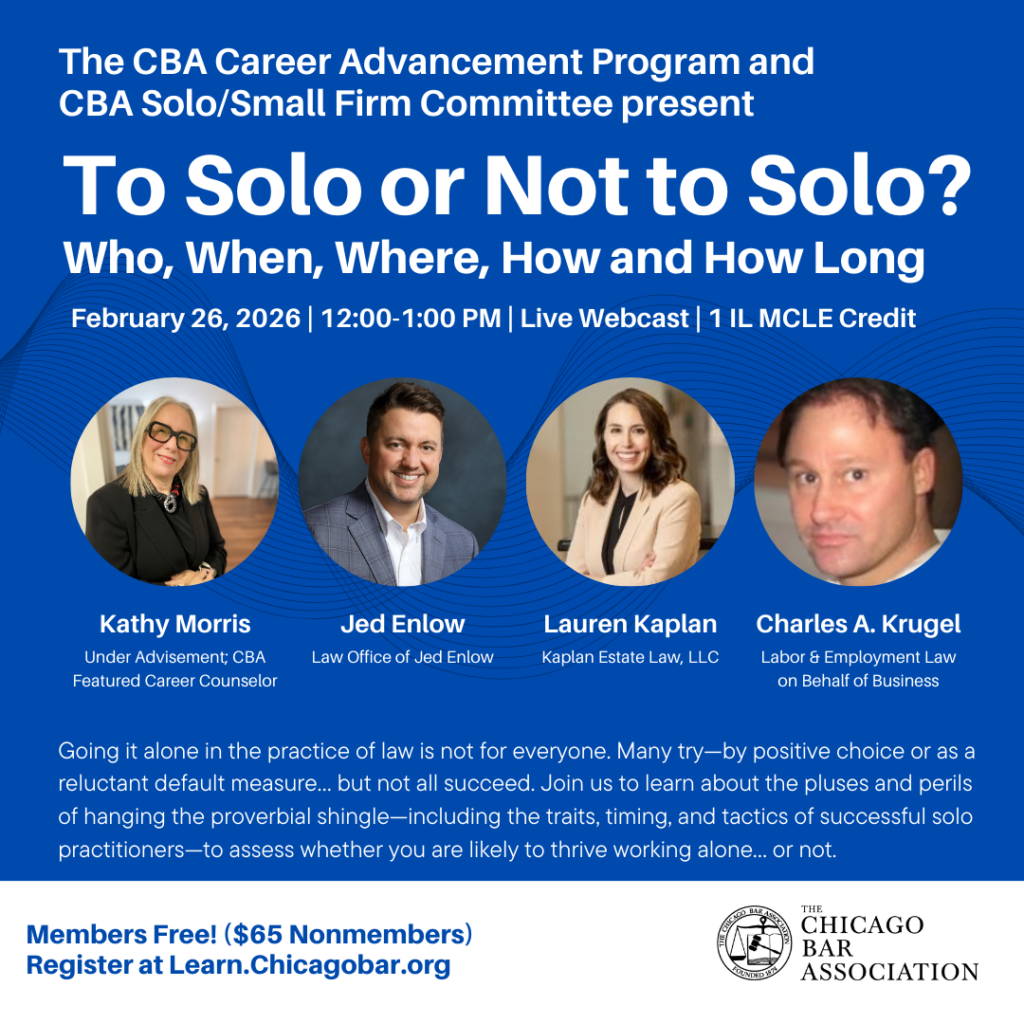

The post CBA Seminar: To Solo or Not to Solo (02/26/26); 1-Hour CLE appeared first on Charles A. Krugel.

Continue Reading CBA Seminar: To Solo or Not to Solo (02/26/26); 1-Hour CLE

Employers Beware: Uptick in BIPA Lawsuits Targeting AI Note-Taking Software

A new wave of litigation under the Illinois Biometric Information Privacy Act (BIPA) has emerged, zeroing in on a technology many employers now routinely use: AI-powered meeting transcription and note-taking tools. In recent months, plaintiffs have filed class actions alleging that vendors like Fireflies.AI collect and store “voiceprints”—unique biometric identifiers derived from speech—without providing the written notice, informed consent, or transparent retention and destruction policies BIPA demands.

Continue Reading Employers Beware: Uptick in BIPA Lawsuits Targeting AI Note-Taking Software

February 2026; The Epitome of Stupidity–Illinois WC "Odd Lot" Total and Permanent Claims; Shawn Biery with New Updated IL WC Rate Chart and more

Synopsis: The Epitome of Stupidity–Illinois WC “Odd Lot” Total and Permanent Claims Get Worse and May Even Have Caused the Demise of this Long-time IL Employer. Editor’s comment: I write with all candor and respect for our various hearing offices but it is hard to make sense of “nonsense.” Please note this is another sad example of a completely made-up work comp term. I say that because the words “odd lot” don’t appear in the IL WC Act or Rules. There are various other States that appear to have it or at least discuss it—Wyoming, Nevada and New Jersey. I giggle at…

Continue Reading February 2026; The Epitome of Stupidity–Illinois WC "Odd Lot" Total and Permanent Claims; Shawn Biery with New Updated IL WC Rate Chart and more

Motion to Dismiss Denial of a Service Animal Goes Down in Flames

The Society of Human Resources Management is not the only employer facing litigation for denying a service animal. On January 13, 2026, the Flaming Gorge Resort saw its motion to dismiss with respect to its denial of a service animal for an employee go down in flames (pun intended). The case is O’Connor v. Colett’s Mountain Resorts, Inc., here, decided by the United States District Court for Utah. As usual, the blog entry is divided into categories and they are: facts; O’Connor’s ADA failure to accommodate claim survives a motion to dismiss; O’Connor’s ADA wrongful termination claim on the…

Continue Reading Motion to Dismiss Denial of a Service Animal Goes Down in Flames

Trump Accounts: A New Player in the Employee Benefits Lineup

JPMorgan Chase, BlackRock, and Charles Schwab have already announced they will match the federal government’s $1,000 seed contribution to Trump accounts for their employees’ children. But for most employers, the question is whether the regulatory landscape is clear enough to make an informed decision.

Continue Reading Trump Accounts: A New Player in the Employee Benefits Lineup

Independent Contractors in Wisconsin Can Create Additional Liability for Employers in the Form of Negligent Supervision Claims

In Wisconsin, negligent supervision claims are only available when there is an employer-employee relationship. Independent contractor (“IC”) or agency relationships do not suffice and, crucially, the individual must be an IC in practice, not just on paper. This is one of many reasons it is important to actively review and manage your independent contractor relationships to ensure they don’t unwittingly morph into employees.

Continue Reading Independent Contractors in Wisconsin Can Create Additional Liability for

Employers in the Form of Negligent Supervision Claims

I’m Quoted in National Law Review Article

![]()

Recruiting and Hiring Without Stepping on Legal Landmines

…

Continue Reading I’m Quoted in National Law Review Article

What’s a Program and ADA Rehabilitation Act Causation Are Not the Same

This week’s blog entry deals with what is a program under Title II of the ADA, and it also discusses the distinction in causation between the ADA and §504 of the Rehabilitation Act. The case of the day is Decker v. Commonwealth of Pennsylvania Department of Corrections, here, a non-precedential decision decided by the Third Circuit on January 15, 2026. As usual, the blog entry is divided into categories and they are: facts; court’s reasoning that the equal protection claim does not survive; court’s reasoning that the ADA claim does survive but the Rehabilitation Act claim does not; and…

Continue Reading What’s a Program and ADA Rehabilitation Act Causation Are Not the Same

SB 464 Guide: California’s New Mandatory Pay Data Penalties for 2026

Effective January 1, 2026, Senate Bill 464 (SB 464) has fundamentally transformed California’s annual pay data reporting framework for employers. The Civil Rights Department (CRD), California’s enforcement agency, now has the authority to levy mandatory fines without judicial discretion.

With the May 13, 2026, deadline for filing 2025 data approaching, it is critical for management to maintain an accurate and up-to-the-minute understanding of these obligations. A proactive approach is now essential to avoid costly compliance failures.

Continue Reading SB 464 Guide: California’s New Mandatory Pay Data Penalties for 2026

DHS Finalizes New Weighted Selection Rule for H-1B Petitions: What Employers Need to Know for the March 2027 Lottery

The U.S. Department of Homeland Security finalized a new rule implementing a weighted selection process for H-1B petitions. Effective February 27, 2026, the rule introduces a weighted selection process that prioritizes H-1B registrations based on the offered wage. This new framework will apply for the upcoming H-1B cap season and may impact your business’s immigration strategy.

Continue Reading DHS Finalizes New Weighted Selection Rule for H-1B Petitions: What

Employers Need to Know for the March 2027 Lottery

Can AI Applicant Screening Trigger FCRA Obligations? Lessons for Employers From the Eightfold AI Lawsuit

This week, consumer advocate lawyers filed a nationwide class action lawsuit against a California-based tech company, Eightfold AI, in California state court. The two named plaintiffs and the proposed class allege Eightfold violated the Fair Credit Reporting Act (“FCRA”) by not giving job applicants notice of the use of AI in the application process nor giving them a chance to dispute any errors.

This lawsuit has potentially far reaching impact on any employer that uses AIto screen and rank applicants—not just Eightfold.

Continue Reading Can AI Applicant Screening Trigger FCRA Obligations? Lessons for Employers

From the Eightfold AI Lawsuit

SHRM Service Dog Litigation: Answer and Possible Defenses

This week’s blog entry considers the Society for Human Resource Management answer to the complaint of Fiona Torres in her case saying SHRM violated the ADA by not allowing her to have her service dog when it rescinded a conditional job offer. In the interest of full disclosure, many years ago I did speak to a SHRM conference in Rochester, Minnesota. I am also a member of SHRM as I like to keep up with what they say with respect to the ADA, though I am not active. I also do not have any SHRM certifications, though as readers know…

Continue Reading SHRM Service Dog Litigation: Answer and Possible Defenses

I’m Extensively Quoted in AI HR Article

Thanks to People Managing People for extensively quoting me in their 1/16/26 article, Can You Build AI Compliance into a Competitive Advantage? by David Rice. QUICK SUMMARY: New transparency regulations are forcing companies to build AI governance infrastructure. Will they build it as a legal checklist or a strategic asset?

Thanks to People Managing People for extensively quoting me in their 1/16/26 article, Can You Build AI Compliance into a Competitive Advantage? by David Rice. QUICK SUMMARY: New transparency regulations are forcing companies to build AI governance infrastructure. Will they build it as a legal checklist or a strategic asset?

The post I’m Extensively Quoted in AI HR Article appeared first on Charles A. Krugel.

Continue Reading I’m Extensively Quoted in AI HR Article

New Client Testimonial & I’m Elected Board Chair for the Lakeside Community Committee

The Lakeside Community Committee, founded in 1964, is a 60+ year old child and family advocacy organization based in Chicago’s Greater Grand Crossing Neighborhood. I’ve been on their board of directors and their attorney for 16 years. I’ve been their board of directors’ vice chair for around seven years.

The Lakeside Community Committee, founded in 1964, is a 60+ year old child and family advocacy organization based in Chicago’s Greater Grand Crossing Neighborhood. I’ve been on their board of directors and their attorney for 16 years. I’ve been their board of directors’ vice chair for around seven years.

Recently, I was elected their board chair, replacing longtime board chair (two decades) Josephine Glover. Our agency works with the Illinois Department of Children and Family Services to provide foster parenting, adoption and shelter services for our state’s children.

I’m excited to assume this role and support our agency’s amazing…

Continue Reading New Client Testimonial & I’m Elected Board Chair for the Lakeside Community Committee

Thousands Apply for Minnesota PFML: What Employers Should Do Now

On January 1, 2026, Minnesota officially launched its state-administered Paid Family and Medical Leave (PFML) program, triggering an immediate surge of over 25,000 benefit applications in the first two weeks alone. As many Minnesotan employers are quickly discovering, the post-PFML workplace poses significant operational challenges. As the legal landscape continues to evolve in Minnesota (and those benefit applications keep rolling in), employers must become intimately familiar not only with administering the program but also with the variety of pitfalls it creates.

Continue Reading Thousands Apply for Minnesota PFML: What Employers Should Do Now

U.S. Department of Labor Issues New FLSA and FMLA Opinion Letters: Key Compliance Takeaways for Employers

The U.S. Department of Labor (DOL) recently released a new set of opinion letters addressing recurring questions under the Fair Labor Standards Act (FLSA) and the Family and Medical Leave Act (FMLA). The latest batch addresses employee classification, overtime calculations, collective bargaining agreements, commission exemptions, and FMLA leave usage. Below, we summarize the most significant takeaways for employers.

Continue Reading U.S. Department of Labor Issues New FLSA and FMLA Opinion Letters: Key

Compliance Takeaways for Employers